15 Good Habits to Save Money and Stay Healthy

When it comes to how we judge the quality of life, there are two essential metrics that stand out: your health and your wealth. Many believe that achieving your ideal balance of both is the key to happiness and success, which is why today we’re going to delve into 15 good habits that help you save money and support your journey towards a healthier, more fulfilling life.

Good Habits for a Good Life

Since the pace of life seems to quicken with each passing day, finding the delicate balance between financial stability and personal well-being can feel like a daunting task. However, the key lies in our daily habits and choices, which shape our financial health and physical vitality.

There is no shortage of ideas for good habits that facilitate a healthy lifestyle. Eat healthy and drink lots of water. Embrace physical activity and manage your health conditions with your doctor. Stay in tune with your emotional and mental well-being, seeing a therapist if necessary.

But what about your financial health? Do your money management habits impact your overall health and happiness?

Health and Wealth Go Hand in Hand

Your relationship with money contributes to so many different aspects of your life. Adopting a money-savvy mindset really goes hand in hand with living a healthy lifestyle. A balanced relationship with money improves your physical health and contributes to overall happiness.

Financial worries are a common source of chronic stress — and we all know how detrimental stress is to our health. Surveys show that financial worries are the top stressor for most people, often leading to sleep loss and various physical ailments like anxiety, headaches, high blood pressure, and depression. This stress creates a vicious cycle, worsening health issues, which in turn makes it more challenging to tackle financial goals.

To break this harmful cycle for your health and bank account, adopting good habits that help you spend your money wisely and prepare for your financial future is crucial.

15 Money-Savvy, Healthy Good Habits

If you’re ready to be more money-savvy while practicing a healthy lifestyle, check out these 15 good habits. I promise these habits are much easier to implement than you think!

1. Meal Planning

Planning your meals not only ensures you eat healthier but also reduces stress and saves money. By knowing what you will cook and eat each day, you can avoid costly (for both your wallet and your waistline) last-minute takeout.

Consider scheduling a grocery pick-up to save time! Not only can you save money by avoiding those impulse purchases, but you’ll be more likely to buy healthy options than when face-to-face with that yummy family-size pack of Oreos at the store.

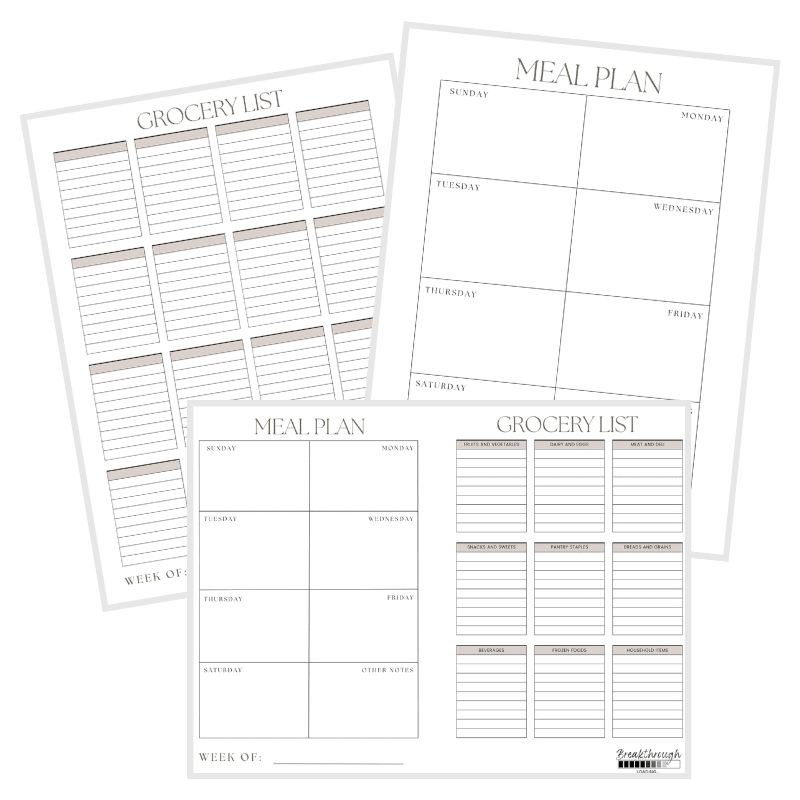

Do you want a copy of my weekly meal planner printable?

Sign up for our newsletter and I’ll send you a free copy of my weekly meal planner and grocery list printable!

2. Carpool

Carpooling is a great way to save money on gas and vehicle maintenance, plus it’s super-efficient for your time — both of which can help reduce your stress. Add the enjoyable social aspect of traveling with a friend and you have a guaranteed health boost.

Think about co-workers, families in your neighborhood with whom you can take turns driving kids, and even friends who want to do weekly errands together. Carpooling is an underrated way to socialize, reduce the environmental impact of your commute, and save time.

3. Limit screen time

We’ve all heard that we should spend less time on our devices and more time being present in our lives — yet the vast majority of us admit to spending far too much time on our phones. But the truth remains that reducing screen time can improve your sleep quality, posture, productivity, mental health, and (yes) your spending habits.

How many times have you made an impulsive online purchase? (Thanks to all my favorite retailers for those oh-so-easy-to-use apps at my fingertips). Or ended up skipping a workout or calling a friend because you got lost scrolling on socials?

Less screen time means more opportunities for getting outside, physical activity, and engaging in productive, budget-friendly hobbies. So set yourself some screen time limits and step away from the phone!

4. Routine health care

Regular check-ups and preventative care can help you become more aware of your health and catch any potential issues early. By investing a little time in routine health care regularly, you are more likely to reduce your long-term medical expenses and avoid health emergencies. Not to mention, prioritizing your health promotes peace of mind and overall well-being.

So, stop beating around the bush and make that appointment for the annual physical or dental cleaning you’ve been putting off. You deserve to be taken care of, but you’re the only one who can make sure it happens!

5. Keep your home tidy

Have you ever heard that your space influences your mental state? Well, it’s true — a tidy home can reduce stress and help you think more clearly. You can also save money by preventing lost items and reduce food waste by being able to easily see what’s in your fridge and pantry.

An organized living space is not only nice to look at, but it also contributes to a healthier mind and wallet.

6. Prioritize sleep

Getting enough sleep is crucial for maintaining good health and productivity. Sleep helps support your immune system, keeps your brain functioning at its best, and improves your overall state of mind — all of which can prevent costly physical and mental health interventions.

And as far as the mood-boosting power of good sleep? No one can argue with that!

7. Drink Lots of Water

Here’s the thing: your body is made of up to 60% water. In order to stay healthy, you need to constantly replenish it by drinking more water.

Staying hydrated is essential for your body’s functions — drinking water supports digestion, boosts energy levels, and improves skin health. Plus, if you fill up your water bottle at home, you’ll save money by avoiding those empty-calorie-packed and expensive beverages at the convenience store or out to eat.

8. Set boundaries

Setting boundaries in your personal and professional life is vital for your mental health. By staying true to yourself and your priorities, you can avoid burnout and other physical implications of stress that can cost your health and bank account.

Prioritizing your well-being will help you stay focused on what matters most to you — and ultimately provide sustainable financial and emotional balance.

9. Get active every day

Everyone knows that regular exercise enhances your physical health and reduces stress. Even better — you don’t even need a costly gym membership to get your sweat on. Walking, cycling, and other home workouts are excellent ways to stay fit while saving money.

And (as if we haven’t said it enough!), staying active has proven to prevent many health conditions that might require costly treatments in the future.

10. Understand your body

Tracking your health metrics (such as your menstrual cycle, weight, blood pressure, and other vital signs) can help you detect underlying conditions early. This proactive approach can keep you in tune with your body’s needs and prevent expensive medical treatments down the road.

Take time to write down your medical and family medical history, and start a health journal. Make note of any sudden changes in weight, energy levels, menstrual cycle, or other unusual symptoms. What you track, you can understand — and it’s so much easier to notice any anomalies when you have this information easily accessible.

11. Practice moderation with alcohol and treats

Enjoying a good glass of wine with dinner or an indulgent dessert every so often is one of life’s greatest pleasures. But, of course, the greatest pleasures are better appreciated when they are the exception, not the rule.

Enjoying alcohol, sweet treats, and other delicious but not-so-healthy foods in moderation is good for your health but also helps you manage your money. Excessive indulgence leads to higher medical costs and unnecessary spending on unhealthy items. Consume less, glow more, and save that money for your future.

12. Give the gift of time

With access to overnight delivery and luxurious presents at our fingertips, we often forget the most precious gift of all — our time.

Spending quality time with loved ones doesn’t have to be expensive, but it will definitely be impactful. Treat your loved one with a visit to a museum or park. Offer to babysit for an exhausted friend who desperately needs a night out. Take your father to his favorite fishing spot for an afternoon. These meaningful experiences will strengthen relationships and create lasting memories worth more than anything money can buy.

13. Find a creative outlet

Embrace your creative side! Activities like painting, writing, crafting, or playing a musical instrument are shown to improve mental health and reduce stress.

Creative hobbies often require minimal financial investment and provide a sense of fulfillment and accomplishment.

CREATIVE KIDS

Bonus Tip: If you have children, encourage them to join you to tap into their creative mindset and see what happens! It’s a great (and cheap!) way to create meaningful memories together.

14. Embrace your sexuality

Having a healthy relationship with your sexuality is shown to boost confidence, happiness, and self-worth. And, of course, that confidence has a significant positive impact on your physical and emotional connection with your romantic partner. The best part? Sexual empowerment is free (except for the occasional new toy or accessory if you so choose).

Embrace who you are and the skin you are in; you might just be amazed at the positive impacts it has in all areas of your life.

15. Establish a Safety Fund and Plan for Retirement

Having an emergency fund and planning for retirement can significantly reduce financial stress. Less stress equals better health, period.

If you know that you have a financial cushion for when an emergency pops up, you won’t be as stressed when you blow a tire on the freeway or need to make an unexpected trip to the ER. When your retirement is well-funded and planned, you can focus on living a healthy and enjoyable life now without constantly worrying about your financial future.

Start saving now to reap the benefits of security now and later.

Building a Better Life One Habit at a Time

By incorporating any (or all!) of these 15 good habits into your daily routine, you are taking steps to secure your financial future and investing in your health and happiness. Prioritizing practices such as meal planning, regular exercise, budget tracking, and mindful spending help ensure your financial stability while nurturing your body and mind with the care they deserve.

So, I leave you today with a challenge: try implementing one (or a few) of these 15 good habits in your life. Trust the process and stick with it for at least three months. And after three months, I dare you to tell me you haven’t noticed positive changes in your well-being and your wallet.

Your health and your wealth are your responsibility (and yours alone). Embrace these small yet consistent actions to build your best life, one habit at a time.

What habits do you currently embrace to enhance your financial stability, health, and overall well-being? Which of the 15 habits resonates with you the most, and how do you plan to incorporate it into your daily routine? Share your thoughts and ideas with us in the comments below — we’d love to hear your insights and experiences!

My goal is to limit screen time and exercise almost every day. I hope I won’t lose motivation. Thank you for the cool tips for a full good life.

Those are two great goals Olga – good luck!